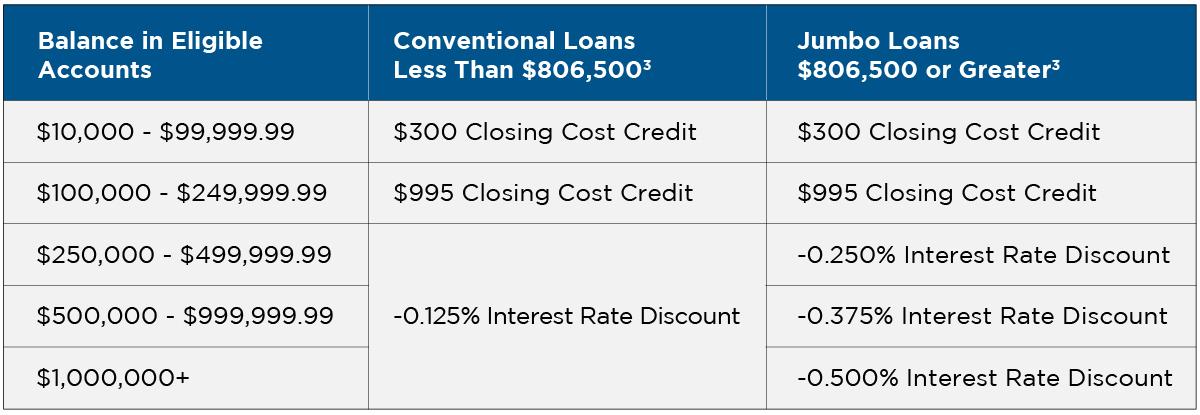

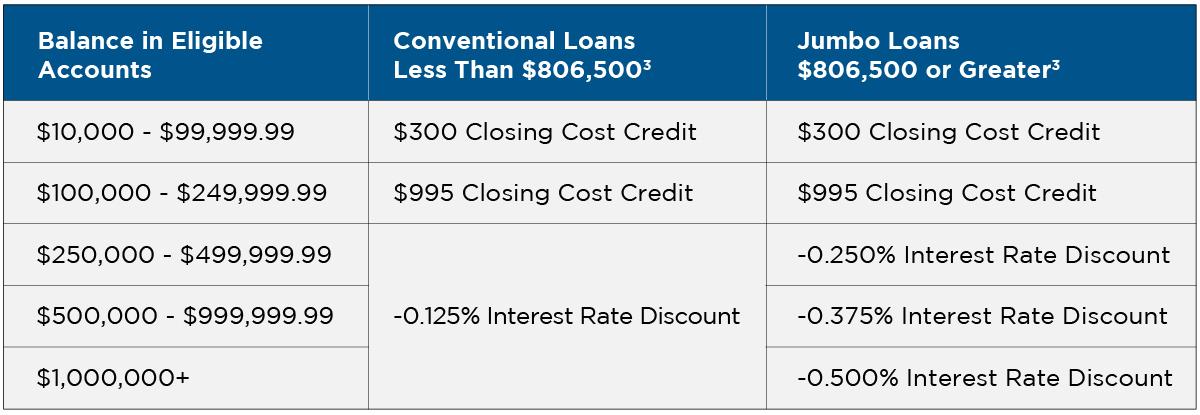

1 Any eligible interest rate discount will be applied and disclosed on your initial disclosure. Your deposit balances will be reviewed during the application process. Any eligible closing cost credit will be applied after the balance verification review and disclosed on your closing disclosure. If your deposit balances do not meet the discount tier threshold prior to closing, your discount or credit may be removed or reduced. It is the responsibility of the borrower to maintain deposit balances throughout the mortgage application process and up to the time of loan closing.

A Cambridge Savings Bank (CSB) deposit account is required to receive an interest rate discount or closing cost credit. The interest rate discount or closing cost credit will be subject to the level of CSB eligible consumer deposit account balances, which will be verified as part of the mortgage loan application process. CSB’s Mortgage Relationship Pricing Program benefits cannot be combined with any other offers or incentives. CSB’s Mortgage Relationship Pricing Program can only be applied prior to loan closing and is subject to account and balance verification. CSB’s Mortgage Relationship Pricing Program is subject to change without notice. Eligible deposit account balances will be verified prior to loan closing. The account balances used to determine the benefit will be funds remaining in the account after any down payment and closing costs for the mortgage transaction.

Deposit balances must be in the account ten (10) business days prior to loan closing. CSB eligible accounts include personal consumer deposit accounts, such as Simple Checking, Performance Checking, Performance Plus Checking, CSB One Checking, Simple Savings, Performance Plus Money Market, Certificates of Deposit (CDs), and Traditional and Roth Individual Retirement Accounts (IRAs). The borrower must be an account title owner on deposit accounts. Balances from small business and commercial accounts, and Trust accounts where the borrower is only titled as a Beneficiary are excluded. The accounts listed above are not intended as an exhaustive list of eligible or ineligible accounts, which are subject to change.

The closing cost credit benefit will not exceed the amount of the Lender Origination Fee and will be applied and disclosed at closing and may not be used prior to closing. For adjustable-rate mortgages (ARMs), the interest rate discount applies only during the initial fixed rate period. CSB’s Mortgage Relationship Pricing Program shall apply only to first mortgage loans. Construction loans are ineligible to receive the discount. The interest rate discount is not available on FHLB Permanent Rate Buydown products.

Terms, conditions, rates, fees for accounts, program, product and services are subject to change without notice. Offer cannot be combined with any other offers. CSB reserves the right to suspend, change and terminate the Mortgage Relationship Pricing Program at any time without notice. This is not a commitment to lend. All loans are subject to credit approval.

Receive up to $12 in monthly ATM surcharge refunds on a Performance Checking account and unlimited ATM surcharge refunds on a Performance Plus Checking account. Please note when traveling abroad you must submit all ATM/Debit Card receipts to receive refunds. A per transaction fee may apply to International ATM & Point of Sale (POS) Transactions. Please refer to the Personal Account Fee Schedule for more information.

When classifying a loan as either a Jumbo or Conforming loan, we use Federal Housing Finance Agency's conforming loan limit values for mortgages acquired by Fannie Mae and Freddie Mac, which is $806,500 for 2025 and subject to change.